A look at trends in mobile phone upgrades and types of plan bought as well as exploring those who spend most on their mobiles every month

Phone owners switching their mobile devices every couple of years has fallen

Apple recently launched their latest iPhone, the iPhone 15, prompting the usual clamour from the most diehard iPhone fans to grab the new device upon its release. But beyond the glitz of the latest mobile launches, our relationship with mobile phones has been changing in recent years.

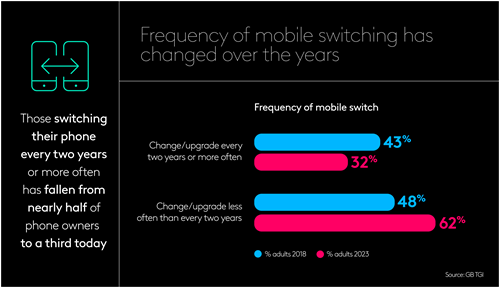

GB TGI data reveals that the proportion of adults who claim they change or upgrade their mobile less frequently than every two years has grown in recent years, whilst the number who claim to switch phones every two years or sooner has fallen. No doubt in part the cost of living crisis plays a role here, but the trend predates this.

In addition, as the cost of monthly call and data packages has fallen over the years, use of pay-as-you-go has declined sharply, from being used by 22% of adults in 2018 to 15% today. Meanwhile, SIM-only deals have grown in popularity (27% of adults in 2018 vs 40% today) whilst a monthly contract that includes the phone has remained relatively steady.

Three-quarters of mobile phone owners spend under £30 a month and this has remained relatively flat over recent years. However, at the top end of the spend spectrum there has been some movement. Today, 8% of mobile owners (4 million adults) claim to spend £50 or more a month on their phone – double the proportion who did so in 2018.

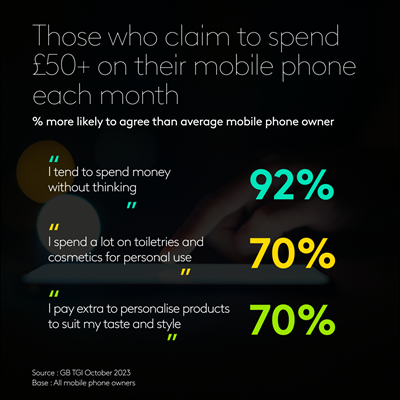

Those who spend £50+ a month on their phone are likely to admit to spending heavily generally.

These high mobile usage spenders are particularly likely to claim a high family income (47% more likely than average mobile owner to have family income £75,000+) but to be feeling the economic pinch – indeed, 46% claim to be finding things ‘difficult’ or ‘very difficult’ on their present income, making them 49% more likely to do so than the average mobile owner.

In part this may be explained by the fact that they have young children to pay for. TGI reveals they are 76% more likely than the average mobile owner to be in the TGI lifestage group ‘Playschool Parents’ (youngest child aged 0-4) and 60% more likely to ‘Primary School Parents’ (youngest child aged 5-9).

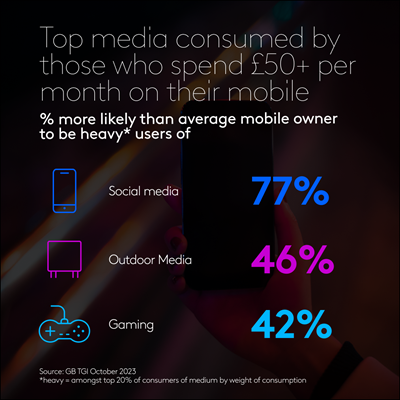

When it comes to targeting this audience efficiently, TGI reveals that this is a group that is particularly likely to be heavy users of a range of media, especially social media, outdoor media and gaming.