Jimena Urquijo shares insights into how changing lifestyles, incomes, and attitudes are reshaping content and advertising strategies

In the wake of the world’s socio-economic shifts, the lifestyles, incomes, and attitudes of consumers continue to transform, directly impacting their loyalty and purchasing behaviours. This transformation – which is compounded by technological progress and increased competition across markets – carries profound implications for businesses worldwide.

In Europe, for instance, we have seen a 48% increase over the last five years in consumers acknowledging that their purchasing decisions are now heavily impacted by the economic outlook, with a 34% increase in heightened household budgeting in which “every penny” is counted*. For all except the very rarest of brands, this trend will have significant implications, requiring adjustments to their strategies.

This article demonstrates how data and insight can help businesses make those adjustments and adapt approaches to pricing, marketing, and customer engagement.

For example, Kantar Media TGI data shows that consumers have certainly tightened their belts in recent years, meaning even minor price variations can sway purchasing decisions.

Tough economic conditions have also led to a shift in the qualities shoppers say they care about, with the freshness and eco credentials of everyday household goods becoming less important (decreasing by 10% and 12%, respectively over the last five years). Meanwhile, the value of loyalty schemes and special offers has increased, by 53% and 11%*.

This heightened price awareness necessitates a more sensitive and nuanced approach, one that acknowledges the fine balance consumers are managing in their daily expenditures. That is why, alongside consumer insight, it is important to leverage data to identify optimal price points that balance profitability and customer needs and sensitivities. Yet this must also be matched with a focus on the overall value that often secures consumer loyalty – although factors like ‘overall quality’ have become less important (-14%), they are still a key consideration.

Retention strategies

Another factor at play is the growing abundance of choice that characterises many markets today. It’s simply easier for consumers to compare products and prices, and there are many more on offer. Consequently, Kantar Media’s TGI data indicates that over the last three years there has been a 12% increase in consumers in Europe and a 5% increase in Latin America who are willing to switch brands for a better deal, underscoring the need for businesses to continually engage and offer value to retain their customers.

We see similar trends in the streaming markets too, with over a third of viewers in Latin America**, for example, agreeing they only watch the free period of 30 days and then switch providers.

Distribution of time and reach may have changed but time is constant – retention is key

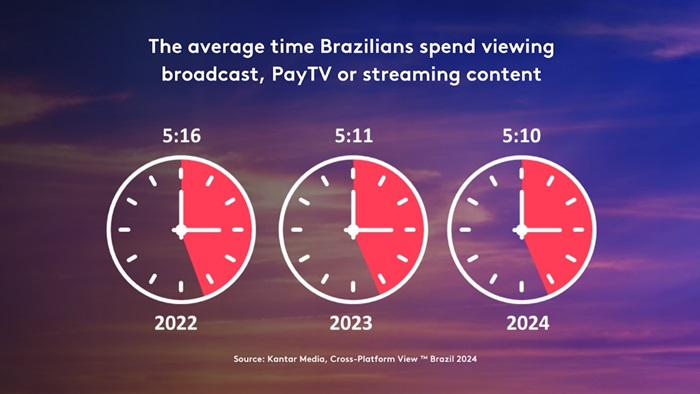

This battle for attention is even sharper when we consider that the total available viewing time for consumers to watch content is largely unchanged – as data from Kantar Media’s Cross-Platform View in Brazil attests. Indeed, over the last three years, the figure has hovered consistently just above five hours, with only six minutes variation***.

The focus therefore has to be on retention. Brands must shift their focus from only acquiring customers to keeping them engaged over time. This involves understanding what drives loyalty among existing customers and implementing strategies to meet these needs consistently. Again, data can illuminate which factors drive customer satisfaction and loyalty, enabling businesses to tailor their offerings accordingly.

Effective segmentation also plays a crucial role here, allowing brands to cater precisely to the unique needs and preferences of different consumer groups. For instance, over the past four years, there has been a significant rise in remote working – a shift initially driven by the pandemic’s necessities, which has now evolved into both an economic and lifestyle choice for many.

Our TGI data underlines that remote workers represent a distinct segment, with specific consumption patterns and behaviours. Notably, they are prone to impulse buying, making them especially receptive to promotions and flash sales.

They also value convenience, preferring streamlined and efficient shopping experiences, and demonstrate a stronger inclination towards environmental consciousness. By using these insights brands can construct a more detailed understanding that can effectively drive retention by aligning with the traits and behaviours of this group.

Making it personal

Localising marketing and media content and personalising interactions can also significantly enhance consumer engagement and retention. TGI data indicates a marked preference for local products and services, as well as a growing demand for personalisation that resonates with an individual’s lifestyle and values.

For instance, consumers have shown a 34% increase in their preference for local shopping, choosing to support nearby stores and locally-sourced products (likely a legacy of the pandemic*). This shift not only reflects a loyalty to local businesses but also a broader desire for authenticity and community-focused consumption.

Furthermore, brands that tailor their messages and offers to the specific needs and desires of their customers can see a profound impact on loyalty. But like any strategy outlined in this article, it won’t happen without the right insight – which is why people-powered measurement, with its rich insights into consumer behaviours, preferences, and lifestyles, is instrumental in building an accurate profile of the target audience. By continuously collecting and analysing this data, businesses can refine their personalisation efforts, optimise strategies, and ultimately foster stronger, more enduring customer relationships.

*Source: Kantar Media Europa TGI (GB, DE, FR & ES) 2019 & 2024

** Source: Kantar Media TGI Latina – 6 Countries – 2023 R2

*** Source: Kantar Media Cross-Platform View Brazil 2024