Recently released TGI monthly topic data shows that consumers still feel financially impacted by the cost-of-living crisis

Many consumers anticipate adopting new financial behaviours in the coming months

There is some cause for cost-of-living-related optimism this year as inflation on the likes of fuel and food appears to be slowing, whilst mortgage rates have begun to dip and energy prices are projected to start coming down in the coming months.

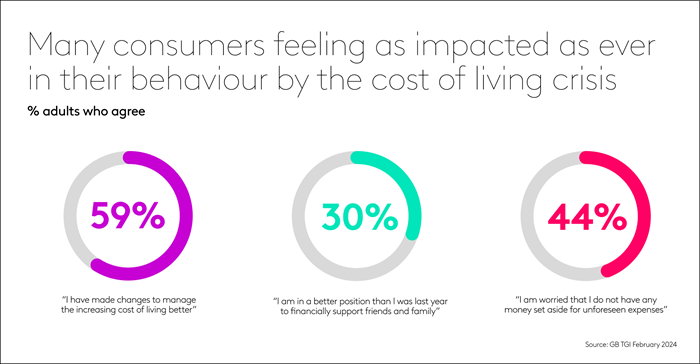

However, recently released TGI monthly topic data shows that for the most part, consumers still feel financially very impacted by the cost-of-living crisis. Fewer than a third claim to be in a better position to give family and friends financial support this year compared to last year, whilst nearly six in 10 claim to have made changes in their lives to better navigate the higher cost of living.

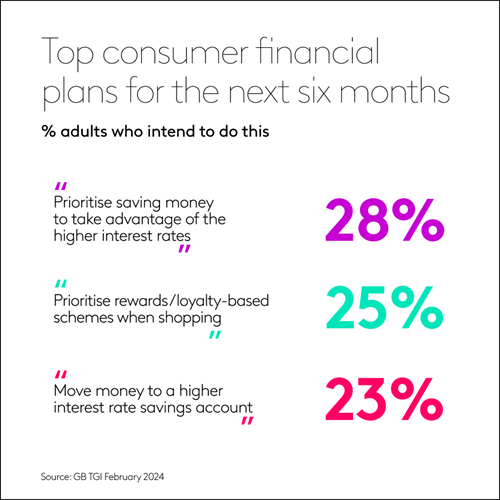

In terms of cost-of-living related changes consumers intend to make in the next 6 months, some of these present opportunities for marketers to tailor their offers and services to attract more business.

For example, a quarter of consumers say they plan to prioritise rewards/loyalty-based schemes when shopping. A similar proportion intend to prioritise saving money to make the most of higher interest rates, including moving money to accounts that pay more.

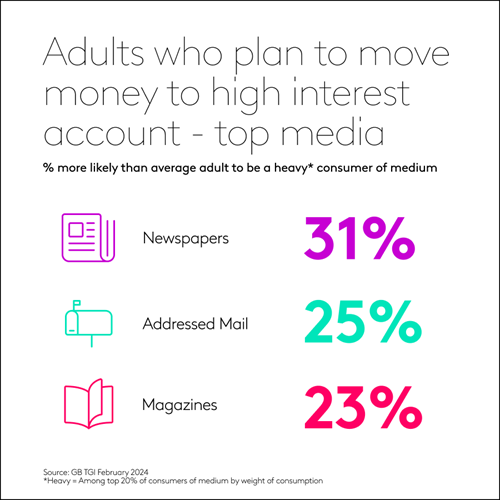

Those who plan to move money to a higher interest rate savings account are particularly likely to be among the heaviest consumers of newspapers, magazines and addressed mail.

Drilling down further when it comes to newspaper engagement, they are especially likely compared to the average adult to claim to be very interested in reading about national news and local news.