As the big summer getaway starts, we explore key consumer holiday trends, including top influences for those yet to book a main holiday this year and engaging prominent niche holidaymaker groups

With most schools breaking up for the summer around now, the big annual getaway for holidaymakers has started. Whilst many people have long since booked their holidays, a considerable proportion of British adults are yet to book a main holiday this year but still plan to do so – making them a top target for travel companies.

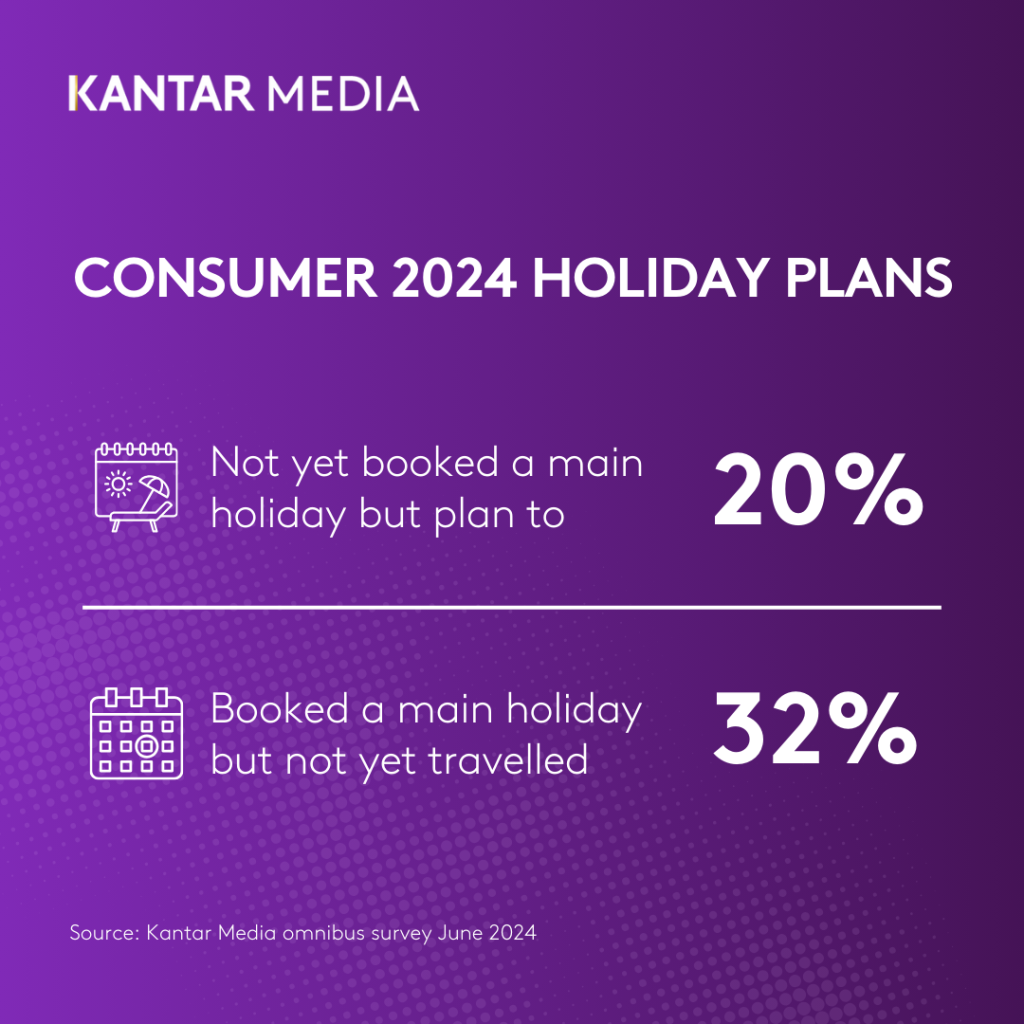

Indeed, fieldwork undertaken by Kantar Media in June reveals that 20% of adults have not yet booked a main holiday in 2024 but plan to. Another 32% have booked a main holiday for this year but are yet to travel, whilst 22% have already had their main holiday.

Top factors influencing holiday decisions for those yet to book

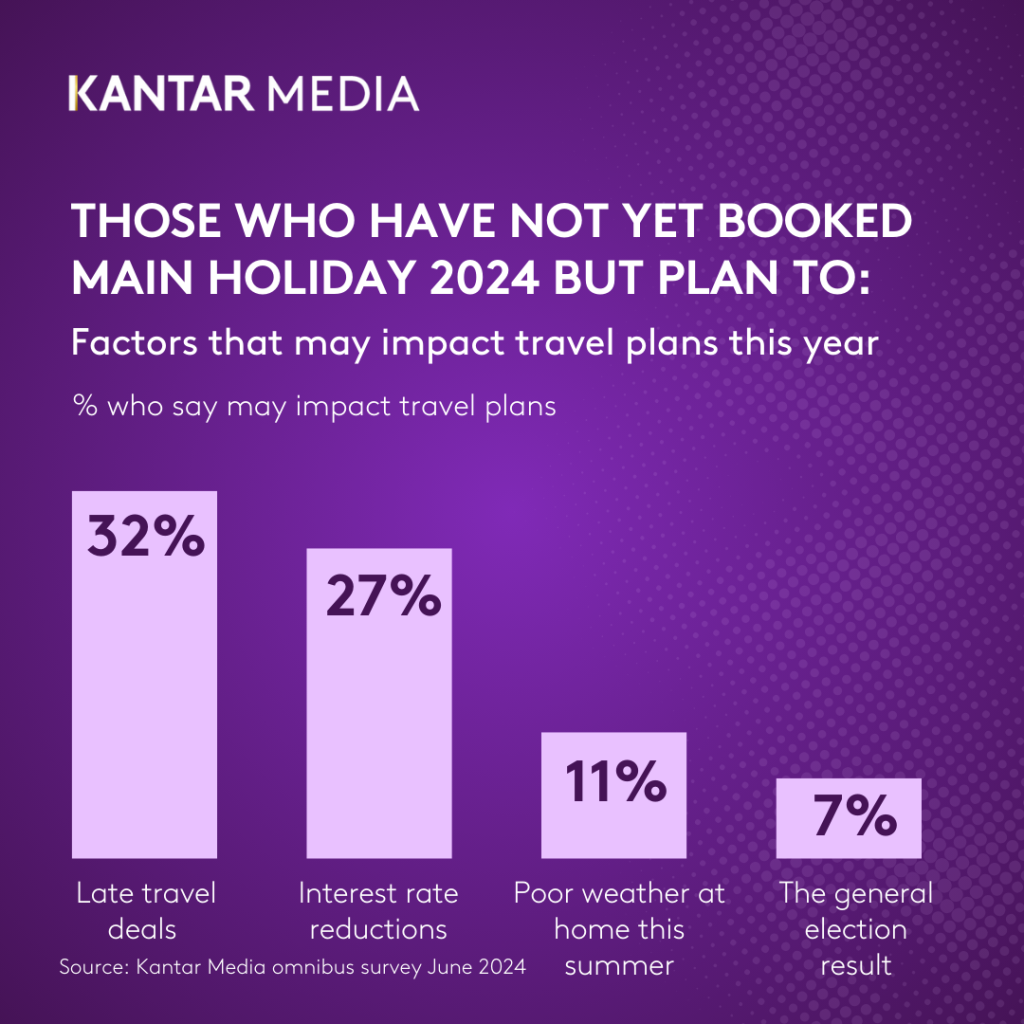

It has already been a year filled with factors that could impact whether and where people take a holiday – from the seemingly never ending rain we have had in Britain these last six months, to the surprise early general election, to the Bank of England holding firm on high interest rates.

Some of these factors have particularly influenced those who have not yet booked a main holiday this year but plan to. Poor weather at home this summer is identified by 27% of this group as something that could influence their holiday plans. However, an imminent reduction in interest rates is a consideration for only 11% and the general election result impacts only 7%.

This could be a positive sign for the travel industry, indicating that uncertain macro economic trends are unlikely to negatively affect the decisions of those still looking to take a holiday this year – whilst recent rainy weather can only help those offering trips abroad.

Significant impact of social media on holiday decisions

The impact of social media on those who are still intending to book a holiday this year should not be under-estimated – it is very much in the mix of key sources of information when booking a holiday. Whilst not quite as prominent as advice from friends and family, or reviews and articles in travel press, it is still an important source for a significant proportion of these consumers.

Indeed, our TGI consumer data reveals that 20% of British adults agree that influencer and social media posts play a big part in their holiday choices. This is a group that is particularly likely to identify recognised tourist destinations as a key factor when they are booking a main holiday – no doubt many are keen to post photos of themselves next to a suitably Instagram-able landmark.

Parents with younger children are particularly likely to be among those for whom social posts influence their holiday choices.

Importance of tailoring messaging by media

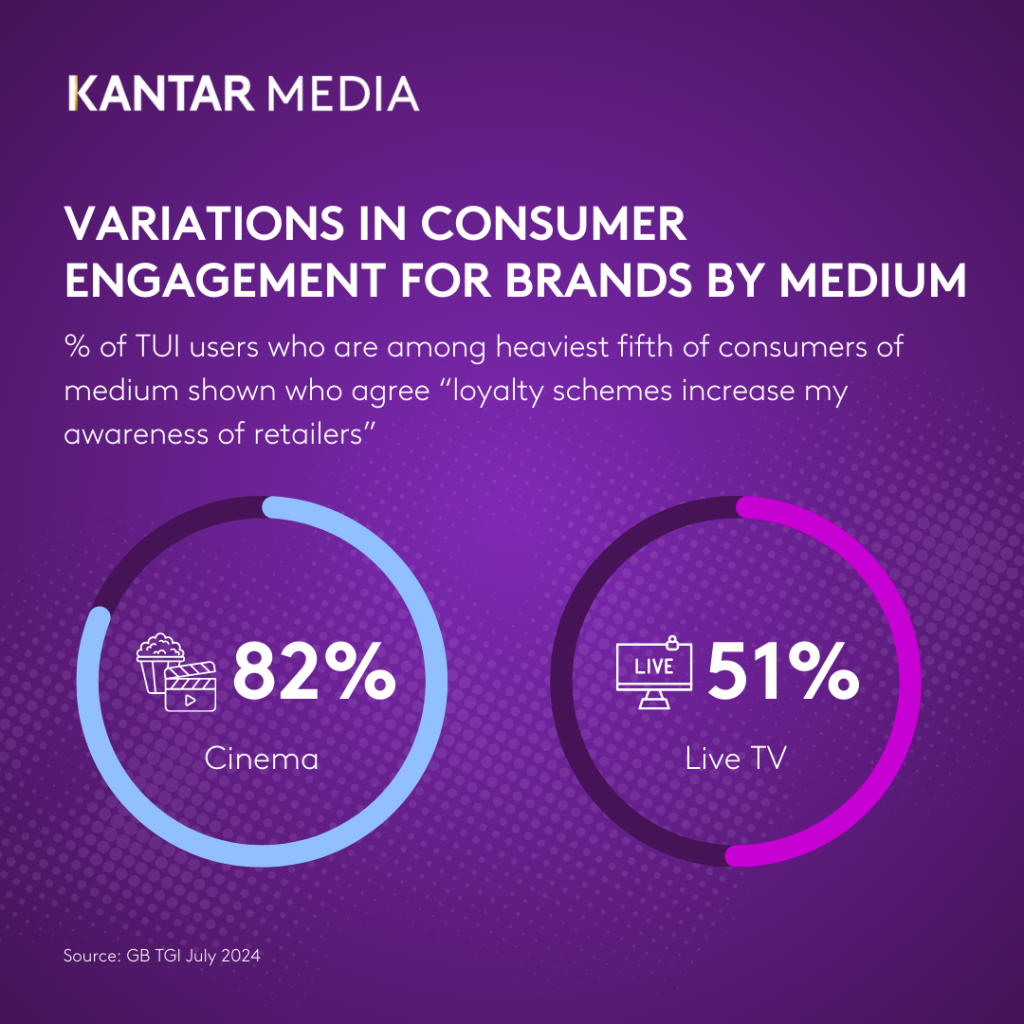

The top attitudes and motivations of users of a particular travel brand can vary considerably across media, making it imperative to tailor messaging by medium to optimise campaigns.

For example, 82% of TUI users who are among the heaviest fifth of consumers of cinema agree ‘Loyalty schemes increase my awareness of retailers’, whereas only 51% of TUI users who are among the heaviest fifth of consumers of live TV agree with this statement.

The value of engaging key niche audiences

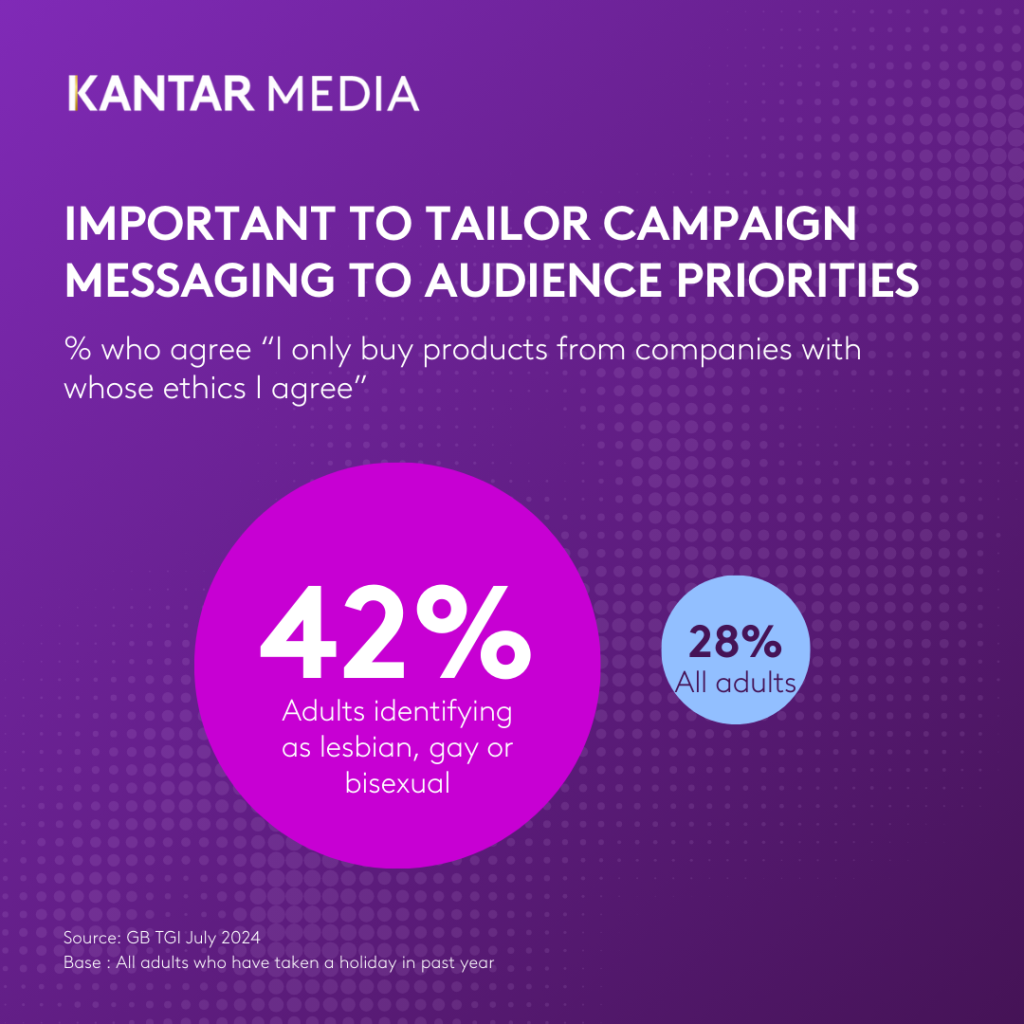

At ABTA’s recent Travel Marketing conference there was much discussion about the importance of understanding the holiday priorities of minority audiences of significant size in order to better engage them, especially LGBTQ+ travellers and those with mobility considerations.

Our GB TGI data reveals that 42% of adults identifying as gay, lesbian or bisexual who have taken a holiday in the past year say they only buy products from a company with whose ethics they agree, compared to just 28% of holiday-ing adults as a whole.

In addition, TGI shows us that those who own a wheelchair or electric wheelchair and have been on holiday in the last year are 59% more likely than the average holiday-ing adult to agree ‘Advertising helps me choose what I buy’.

Find out more

Download our 2024 consumer travel trends report for an understanding of the holiday intentions and behaviours of British consumer across this year.