As global viewing platforms expand their reach, it becomes imperative for advertisers and media owners to understand the distinct characteristics of local markets, writes Mesut Sakal

Viewing has been revolutionised by video streaming platforms, offering unparalleled opportunities for advertisers and media owners to reach global audiences. Last year, we published the Future Viewing Experience report in which we explored the emerging trends and behaviours redefining the viewing landscape and new strategies for audience retention and monetization. One of the crucial factors to consider is regional preferences as local media markets can exhibit distinct characteristics which may involve different business strategies.

Indeed, it’s now clearer than ever that regionality plays a significant role in shaping viewership patterns and must therefore be considered when formulating advertising and content strategies.

Based on unique insights from Kantar Media, this article sheds light on the impact of regionality on our viewing habits and highlights some important market variations to consider before making strategic decisions.

Seasonal influences

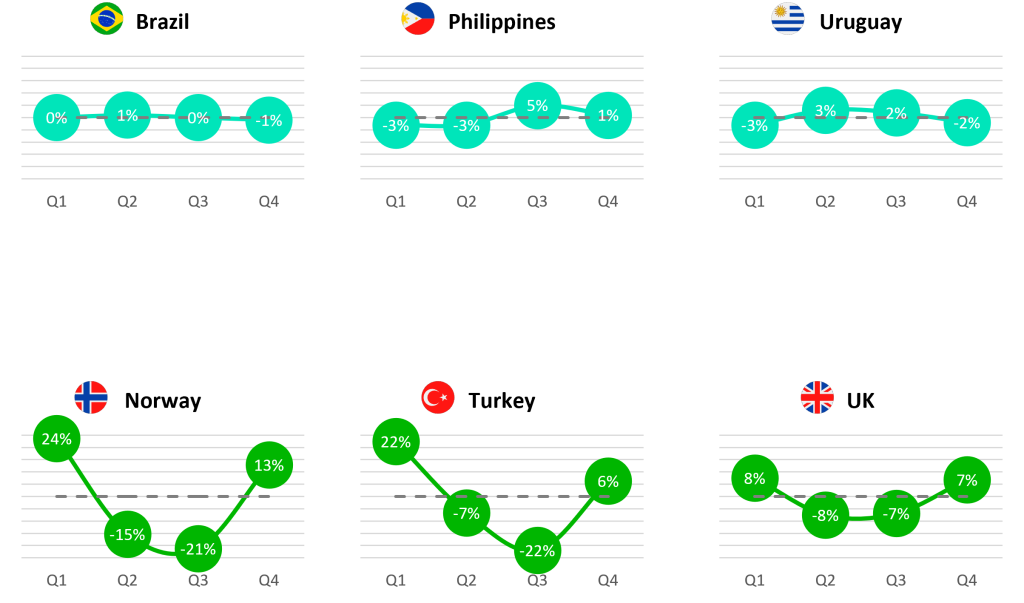

One key aspect of regionality is the ‘shape of viewing’ across different markets, which can be influenced by seasonal events. For instance, in countries like Brazil, where climate changes are relatively stable throughout the year, there is minimal variation in viewing habits.

Conversely, countries such as Norway, Turkey, and the UK experience more extreme seasonal fluctuations, leading to spikes in winter months when people spend considerably more time at home. Understanding these variations is useful for content and marketing strategies, and demonstrates why global strategies might work differently at the local level.

One size doesn’t fit all

The ‘shape’ of viewing across the year can vary across Kantar markets

Linear vs. non-linear

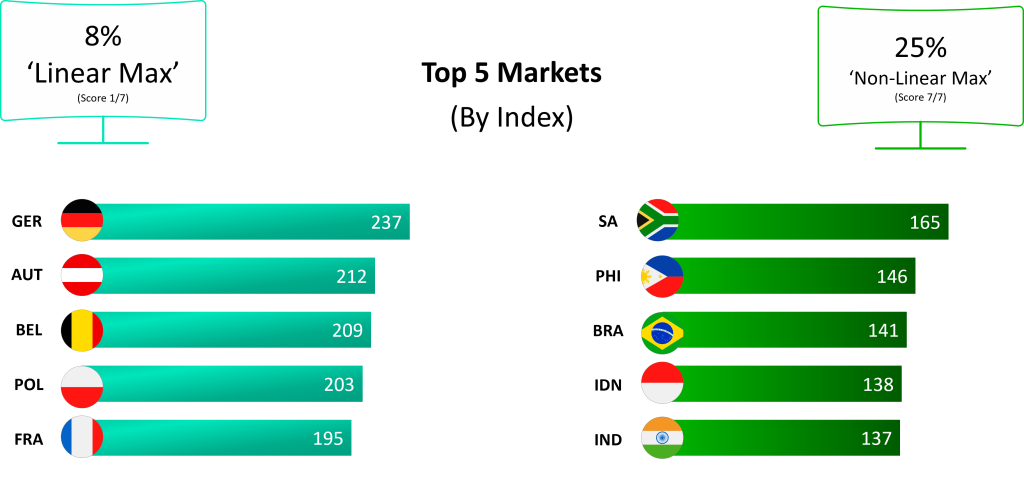

Audiences in different regions also exhibit variations in their preference for linear or non-linear viewing. For example, in our latest TGI Quick View survey – which gathers data from 85,000 connected consumers across 35 countries – respondents were asked to rate their TV-watching habits on a seven-point scale, with one indicating most TV viewing through traditional channels and seven representing a preference for on-demand catch-up or online platforms.

We can see the rise in those who prefer to view on demand, catch-up or online – with almost half of all connected consumers selecting the top two boxes.

Understanding viewing habits | Linear vs Non-linear viewing preference

Delving deeper, TGI Global Quick View reveals that markets such as France, Germany and Austria are more likely than the global average to prefer linear viewing, while the Philippines, Brazil and India exhibit a higher tendency towards non-linear and streaming-first behaviours.

Profiling “Linear” vs “Non-Linear” viewers | Market differences

These regional variations demonstrate a clear need for marketers and content owners alike to understand how best to adapt their plans to best meet the needs of local markets – while failure to do so may result in wasted efforts or misjudged opportunities.

Paid vs. free video-on-demand

Over the past three years, during which time the likes of Netflix and Disney+ have boosted their range of subscription plans, TGI data reveals important shifts in both paid viewing and free ad-funded viewing. For example, markets such as Denmark, Norway, Sweden, Spain, and the UK show a higher share of paid video-on-demand content, indicating ingrained consumer behaviours around subscription-based services.

In contrast, markets like Taiwan, Egypt, Japan, Hong Kong, and Thailand exhibit a greater inclination towards free ad-supported video-on-demand platforms.

Profiling “Linear” vs “Non-Linear” viewers | Market differences

Using TGI Global Quick View, we can build a global picture of VOD audiences by plotting countries by the extent to which they opt for ‘non-linear’ first and their share of total VOD minutes viewed on paid platforms.

Users can visualise how markets differ in the characteristics of their VOD audiences – enabling platforms and content distributors to finetune their strategies according to the market.

For platforms considering different business models, something we see increasing evidence for, this insight should help them understand which markets might pose better prospects. While for marketers, it signifies which regions might have more barriers for targeting video ads, particularly in the connected TV market.

Content preferences and viewing habits

Different cultures have different values and preferences. What resonates with an audience in one country may not resonate with an audience in another. For example, the US audience’s preference for property, DIY, drama, and game show quizzes reflects their values of home ownership, self-reliance, and entertainment. The Argentine audience’s preference for soaps, chat shows, and property-related content reflects their values of family, community, and practicality. While the Filipino audience’s preference for faith and spirituality, technology, gadgets, and single plays reflects their values of religion, innovation, and entertainment.

By tailoring advertising and content strategies to resonate with local audiences, businesses can increase their chances of reaching their target market and achieving their marketing goals.

The importance of measurement

By understanding the nuances of different markets, advertisers and media owners can tailor their strategies, optimise audience targeting, and unlock the full potential of streaming platforms on a global scale.

As Miguel Gutiérrez-Cortines, Head of Insights at OMD Spain observes: “Although a global strategy can provide a solid foundation, it is essential to allow a certain flexibility and adaptation at a local level. Every market has its own preferences and behaviours – which is why personalisation and adaptation of campaign messages to each context are fundamental to the success of the campaign.”

Advanced measurement systems and analytics stand as indispensable tools in this pursuit. They offer unparalleled insights into audience behaviours, preferences, and demographics across various markets, serving as a compass for informed decision-making and paving the way for more effective targeting and content creation.

Yet, data and insight reach their true potential when combined with the expertise of local professionals and agencies – so seek them out. Human knowledge and experience complement the data-driven approach, maximising efforts and extracting additional value from cross-border strategies.

Indeed, together they can help advertisers and media owners embrace the growing power of regionality – and pave the way for a locally deep yet globally successful presence.

Mesut Sakal is Managing Director for Kantar Media Turkey, CEE and Middle East.