Our latest TGI data reveals the purchase behaviours and consumption habits of Valentine’s Day present buyers in Britain

Valentine’s Day is one of the first big post-Christmas present purchasing occasions and as such represents a key opportunity for brands who may have witnessed lean sales since the Christmas period as many consumers sought to save in January after splashing out in December.

Latest GB TGI data reveals that 27% of adults in Britain claim to have bought presents for Valentine’s Day in the last 12 months – a figure that has remained relatively steady in recent years.

Many of these Valentine’s gifters are happy to spend a considerable amount. A quarter of them, representing 3.7 million adults, claim to have spent £50 or more on Valentine’s gifts in the last year.

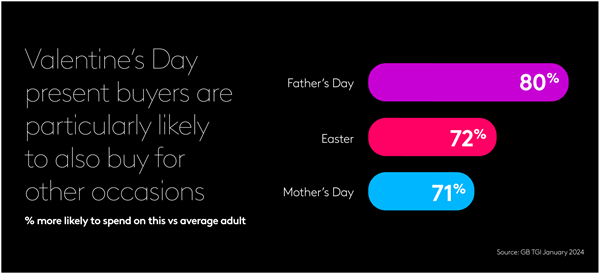

Engaging Valentine’s Day shoppers around other prominent gifting days could also prove valuable to marketers, as TGI reveals they are particularly likely to spend on a variety of other such occasions.

Those who are married or living as a couple are 32% more likely than the average adult to make Valentine’s-related purchases. However, 15% of single people, representing 2.2 million adults, also claim to do so, as do 4% (over 600,000 people) of those who are divorced or separated.

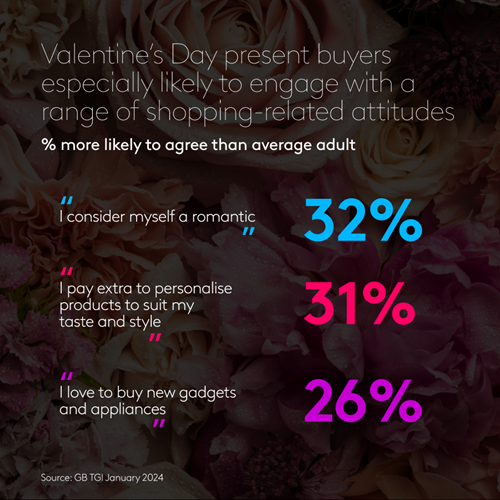

You would hope Valentine’s present purchasers would be particularly romantically inclined and indeed TGI reveals that 53% of them say they consider themselves romantic, compared to only 40% of adults generally. Their attitudes also reveal them to be particularly prepared to spend extra when shopping and to have a predilection towards buying certain products.

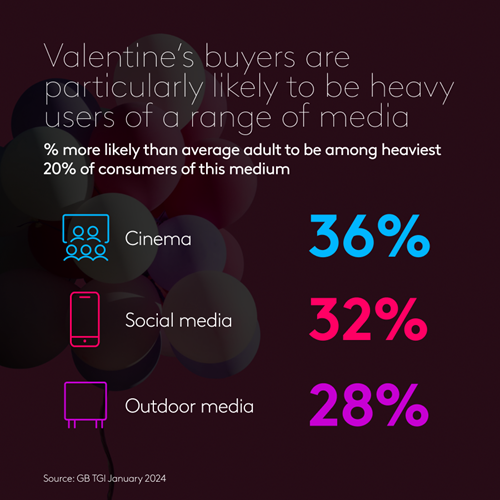

When it comes to advertising and media, Valentine’s purchasers are 28% more likely than the average adult to agree that advertising helps them choose what they buy. In terms of media preferences, they are more likely than the average adult to be amongst the heaviest consumers of a range of media – most notably cinema, social media and outdoor media.

This is reflected in some of their attitudes. For example, they are 29% more likely than the average adult to agree that out of home advertising improves their perception of a brand and 28% more likely to say online adverts influence the brands they buy.