The boss of Currys claimed smart speaker sales have ‘fallen off a cliff’, on the eve of Amazon’s Prime Day. So how are consumers today engaging with such tech?

Currys boss Alex Baldock was in the news last week for saying that customers are cutting back and trading down on electrical items during the cost of living crisis. He highlighted in particular that smart speaker sales had ‘fallen off a cliff’. The timing of the comments from Currys is particularly notable with Amazon having run their vaunted Prime Day this week.

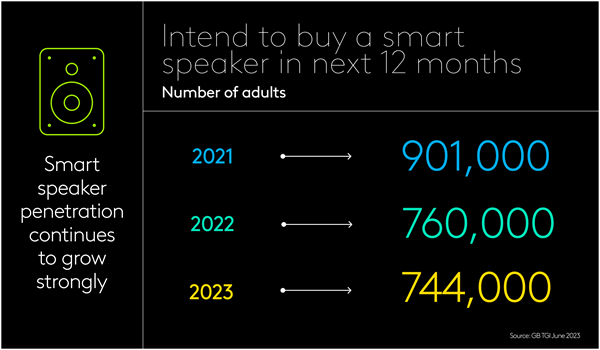

So how does the experience of Currys compare to how British consumers feel today about smart speakers and other tech? When it comes to intention to buy, little has changed in recent years. GB TGI data reveals that today 1.4% of adults – 744,000 people – express an intention to buy a smart speaker in the next 12 months.

This figure has been relatively static across recent years, albeit with a slight fall since the cost of living crisis began to bite.

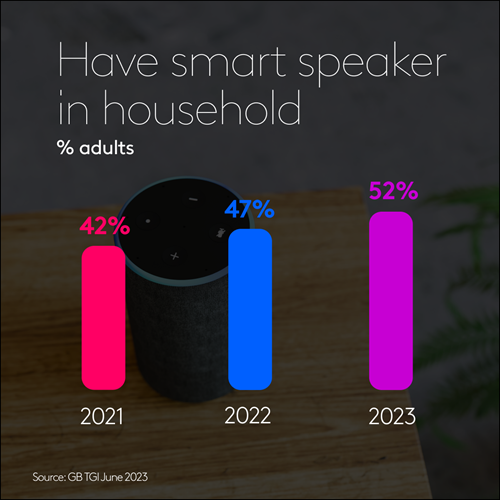

However, if we look instead at smart speaker claimed penetration, this has seen an inexorable rise undimmed by the cost of living crisis. In 2020 30% of adults claimed to have a smart speaker at home. Two years later this had risen to 47% and in the past year it has jumped again to 52% today.

This is far higher penetration than for other western European countries. Our TGI Europa data shows that in Germany 40% of adults claim to have a smart speaker at home, with the equivalent figures in Spain and France 23% and 18% respectively.

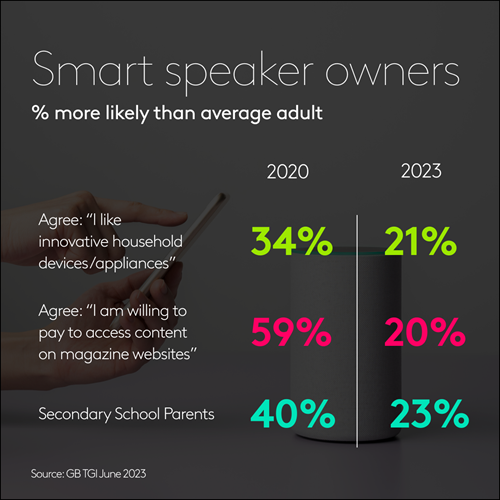

Turning our attention to what types of consumers tend to own smart speakers, they have changed little in recent years, although as smart speaker claimed penetration was less than a third of adults three years ago compared to more than half today, there is a consequent impact on how different from the average adult such owners can be.

However, TGI shows they are still significantly more likely than the average adult to be parents of school age children and to be especially interested in owning new tech. When it comes to their media consumption they are still more likely today to be willing to pay to access content on magazine websites.