The high costs of both childcare and mortgages mean many parents of pre-school children, despite earning a solid income, feel financially stretched and need to cut costs wherever they can. Here we explore this audience in more detail, including how they can best be targeted and engaged.

News of more funding for pre-school childcare in Britain was welcomed by many parents when it was announced last year. However, costs remain high as some nurseries hike prices significantly amid claims the extra funding won’t cover their rising staffing costs and national insurance contributions.

On top of this, mortgage rates remain high after jumping considerably in recent years, meaning many parents of young children are also paying considerably more each month in housing costs.

On paper, Playschool Parents look relatively well off, but they face big financial pressures

Playschool Parents (those who live with a son or daughter aged 0-4) may seem a particularly lucrative target for marketers. After all, TGI shows that they are almost four times more likely than the average adult to have a personal income of £75,000 or more.

However, childcare and mortgage costs can leave them with little left at the end of the month. Indeed, TGI reveals that Playschool Parents are over three times more likely than the average adult to be paying a mortgage with monthly repayments of at least £1,000.

A smaller proportion of mortgage-paying Playschool Parents claim to be comfortable on their present income than adults more generally who have a mortgage (23% are comfortable on present income compared to 28% of people overall who have a mortgage).

This holds true even for those Playschool Parents earning higher amounts. Indeed, Playschool Parents who have a family income of £75,000 or more are not significantly more likely than the average adult who has a mortgage to claim they are comfortable on their present income (30% do so).

Playschool Parents show a range of cost cutting behaviours

When it comes to shopping behaviours, mortgage-paying Playschool Parents are more likely than the average adult with a mortgage to display a variety of cost-cutting behaviours and attitudes, including budgeting for every penny when doing household shopping and switching between brands depending on what is on special offer.

Playschool Parents can be impactfully reached in a variety of ways

However, that is not to say that focusing on low cost is the only way to engage Playschool Parents. TGI reveals a number of standout attitudes and behaviours relating to their spending.

For example, they are 57% more likely than the average mortgage-payer to say they buy new products before most of their friends, 43% more likely to say they feel reassured using products recommended by an expert and 42% more likely to claim to only buy products from a company with whose ethics they agree.

This is important, because for many marketers these parents remain a key target in spite of the financial pressures they are under, not least for child-related products and services, but also a whole host of financial services.

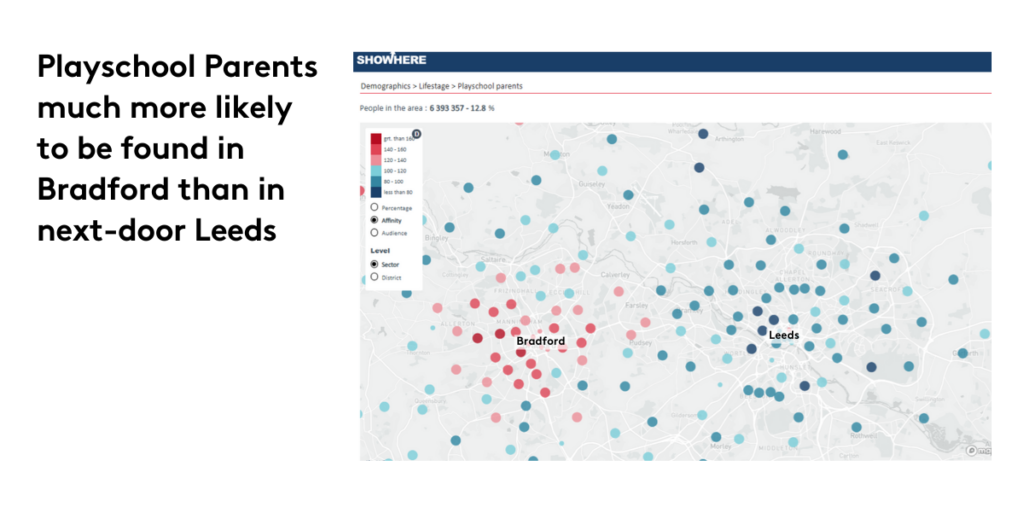

Our TGI Geo Affinities solution reveals that Playschool Parents are particularly likely to be found in certain areas of the country, which allows for better targeted ad campaigns. For example, they are especially likely to be found in Bradford, compared to the average adult, but significantly less likely to be found in next-door Leeds.