Subscription advertising video on demand (SAVOD) marks an opportunity for viewers, platforms and marketers alike, writes our TGI and Insight MD, Rachel Macey — but it’s not without challenges

How subscription advertising video on demand is reshaping the streaming landscape

Streaming platforms are knee deep in experimentation. At least they should be. The rise of Subscription Advertising Video On Demand (SAVOD) marks a major strategic shift in the industry, offering a hybrid model that blends paid subscriptions with ad-funded content to make streaming more affordable for consumers while opening new revenue opportunities for platforms.

As noted in our Media Trends and Predictions 2025, it’s all part of a wider shift towards more diverse business models in response to evolving consumer behaviour, technological innovation, and market dynamics. The reliance on a single revenue stream is fading — if it’s not already dead — and SAVOD is emerging as a compelling solution.

In a market that is increasingly crowded, competition for viewer attention is naturally intensifying — but there’s a limit to what most people can afford, and strategic choices are being made. If, for example, a family household subscribes to a platform for just one must–see show — a scenario that may feel increasingly familiar to many of us — the value proposition looks very different from that of a service offering multiple must-watch series. This leaves many people seeking a better overall deal which factors in time, cost and a certain threshold for ad exposure.

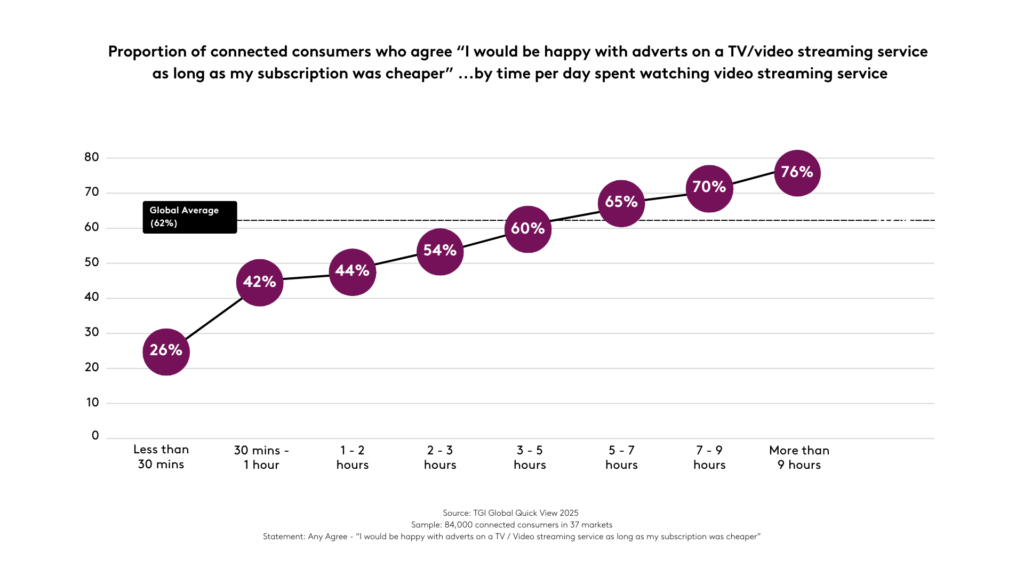

So as the entire ecosystem — including viewers — experiments, here’s what we know for certain: most connected consumers worldwide are open to advertising if it means lower streaming costs. This insight, revealed by Kantar Media’s TGI Global Quick View (GQV) 2025, suggests a growing acceptance of ads in exchange for affordability, particularly among heavy users of streaming services.

Indeed, those who consume over three hours of paid video streaming daily are significantly more likely to accept ads if it reduces their subscription fees. These users, often subscribed to multiple services, seek cost-saving measures while maintaining access to diverse content. In contrast, lighter users, who have less time to spend on streaming, tend to resist ad-supported models, as ad interruptions make their limited viewing time less enjoyable.

It is not a globally consistent picture, however. For instance, viewers in Nigeria are 25% more likely than the average paid streaming user to accept ads for a cheaper subscription, while in the Philippines, they are 17% more likely.

By contrast, this willingness drops sharply in Western markets. In Sweden, for example, viewers are 67% less likely to agree, and in the Netherlands, 43% less likely.

Taken together, these factors will impact how streaming services must approach their SAVOD strategies, and which markets or market segments are going to be most receptive. There can certainly be no one-size-fits-all approach.

Adding a further layer of complexity, subscription models are also no longer solely about content. For example, many subscriptions are now part of bundling deals, such as those that come with a broadband provider, which will impact loyalty, churn and the likelihood of how consumers perceive value. Consider other factors, such as the amount of friction in cancelling or pausing contracts, the number of accounts permitted per subscription, or price more generally, and streaming platforms find themselves operating within a complex ecosystem of interconnected elements.

Consequently, they will require reliable consumer insight to ensure they fully understand these nuanced and shifting dynamics — and when, where and how to implement the best SAVOD strategies, factoring in how viewers might perceive value in a diverse mix of subscription packages.

Considerations for marketers

Opening up subscription VOD platforms to advertisers presents many opportunities, particularly in markets with high demand for more video inventory and more precise targeting. However, this new landscape brings unique complexities for the buy side as well.

For example, despite technically offering better targeting capabilities, SAVOD may segment audiences along economic lines by virtue of its inherent characteristics, rather than an option for advertisers.

Indeed, TGI GQV shows that while searches for advertised products during streaming are more prevalent in developing markets, higher purchasing power often resides in different demographic segments.

Another challenge lies in the distinction between viewer profiles and platform profiles. While platforms collect data on subscribers, which helps with targeting, widespread account sharing means the actual viewers may differ significantly from the registered account holder. A subscription might be in one person’s name, but several family members or friends with diverse demographics and interests could be using the same account.

This makes it essential for platforms to implement usage-based targeting, analysing individual viewing habits rather than relying solely on subscriber data. It should also prompt marketers to consider adopting contextual advertising that ensures ads are relevant to the current viewing experience, regardless of who is watching, or build a more comprehensive profile through third-party data.

For instance, Samsung Ads sought to enhance its firts party data from connected TVs by incoporating third-party data , enabling advertisers to buy against industry-standard addressable audeinces. It achieved this by using TGI data to predict the characteristaics of Samsung Smart TV viewers without relying on personally identificable information. This demonstrates how trusted third-arty data can support brands that have their own first party metrics but face challenges in fully commercialising then, helping them better understand and target TV audiences.

If these challenges can be overcome, SAVOD advertising certainly offers clear advantages — particularly in its ability to deliver more precise targeting based on viewers’ preferences, demographics, and viewing habits. It also opens opportunities for interactive, personalised, or contextual ad formats, as well as ad breaks of different lengths or intervals that might boost viewer engagement.

However, marketers must weigh these potential benefits against the realities of account sharing, audience segmentation, and the need for robust measurement methodologies that accurately attribute conversions in this evolving market. Ultimately, a successful SAVOD advertising strategy requires a nuanced understanding of the platform’s unique dynamics and a data-driven approach to campaign optimisation.

As ad-supported streaming gains momentum, platforms need to keep experimenting, learning, and fine-tuning their approach. It’s clear that hybrid and flexible monetisation strategies are shaping the future. The real winners will be those who tap into consumer insights and craft strategies that feel thoughtful and aligned with what audiences truly want from their streaming experience.

Please complete the form to access our full Media Trends & Predictions Report 2025