An exploration of the growing engagement among men in Britain with toiletries and cosmetics and how best to reach this audience

The beauty products industry is filled with a variety of large multinational brands competing for a lucrative share of this valuable market. Yet there are also a number of successful solo entrepreneurs who have built large beauty businesses from their kitchen table in recent years, using social media to help build a solid base of users.

In such a competitive space an increasing number of businesses have looked to invest in male-specific beauty products to leverage a side of the market widely considered ripe for greater expansion.

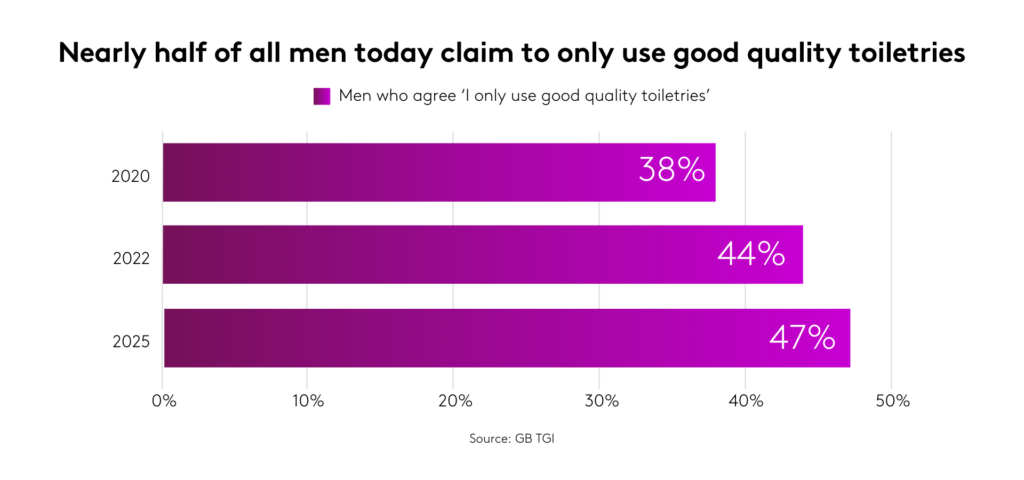

Our TGI data reveals that there has been a considerable rise in engagement with toiletries and cosmetics among British men in recent years.

The proportion of men who claim to be interested in innovations in cosmetics has risen from 12% in 2021 to 20% today, according to latest 2025 GB TGI data. By contrast the proportion of women with the same view has remained largely flat over the same time period.

That is not the only male toiletries-related attitude to have seen growth in recent years. The proportion of men who claim that when buying toiletries the brand they choose is very important to them has also risen, up from 29% in 2021 to 35% today. Similarly, the proportion of men who say they only use good quality toiletries has also gone up.

Male fans of quality toiletries display a number of behavioural and attitudinal differences to other men

It is not generally the youngest or oldest men who are especially likely to engage with cosmetics, but those with young families. TGI reveals that those who say they use only good quality toiletries are 35% more likely than other men to be ‘Playschool Parents’ (youngest child aged under 5) and ‘Primary School Parents’ (youngest child aged 5-9).

Men who claim they only use good quality toiletries are also particularly likely to be heavy users of a range of specific products, increasing their potential value to high-end brands. For example they are 32% more likely than other men to use hand cream more than once a day, 24% more likely to use hair conditioner once a day or more and 41% more likely to have had a therapy or treatment such as a massage or wax in the past year.

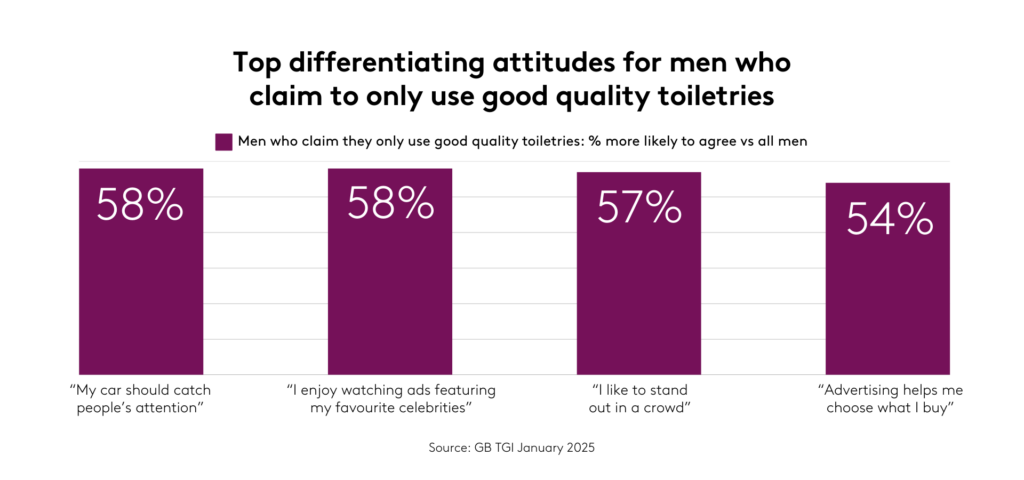

Attitudinally, these men who prefer to use good quality cosmetics are especially likely compared to other men to like to stand out and engage with advertising, providing direction to marketers in how they can best go about engaging this cohort

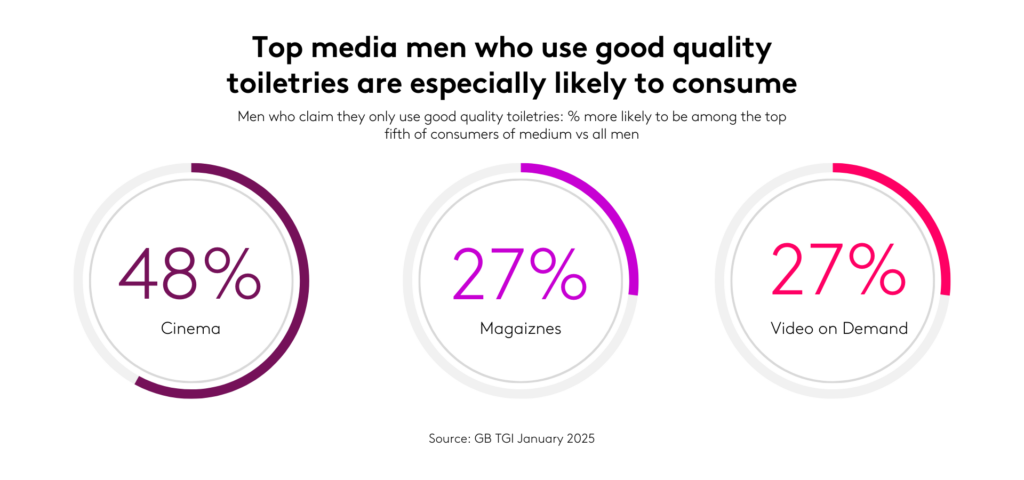

Cinema, magazines and video-on-demand especially likely to be consumed by male quality toiletries fans

Those men who claim to use good quality toiletries are especially likely to consume a range of media with which they can be effectively targeted. TGI reveals that they are considerably more likely than other men to be among the heaviest fifth of consumers of cinema, magazines and video-on-demand.

Drilling down further for opportunities to engage this audience efficiently through a medium which they are especially likely to consume, TGI reveals that when it comes to cinema their favourite film types are action, science fiction and superhero movies.