The proportion of adults claiming to use online-only banks has doubled in recent years. We explore who is driving this rise in adoption

Challenger banks – that is, a bank that offers financial services exclusively online and challenges the traditional banking model – have seen considerable growth in recent years. Our TGI consumer data reveals that in 2020 5% of adults claimed to have a bank account with either Monzo, Revolut or Starling, but by 2023 this figure had doubled.

Such banks cater to important trends in the way consumers are engaging with banking services. Here we explore those who use challenger banks and what opportunities exist for these banking brands to continue to grow in the future.

Today, 14% of adults in Britain who have a bank account claim to have an account with one of the big four ‘challenger’ banks (specifically either Monzo, Revolut, Starling, or Chase) accounting for 6.7 million people.

A little under half of adults with a bank account feel online-only banks are just as trustworthy

40% of adults in Britain (20 million people) with a bank account agree “Online only banks are as trustworthy as traditional banks” and this figure has remained consistent across recent years.

Understandably though, a much greater proportion of those with an account at a challenger bank agree with this sentiment: 58% of them believe they are just as trustworthy as traditional banks.

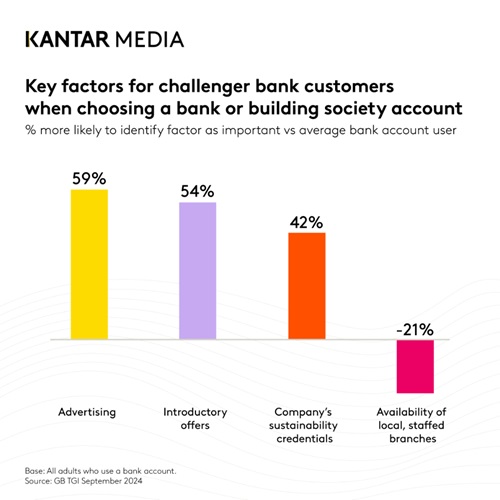

Several factors particularly likely to be important to challenger bank users when choosing a bank account

Those who have an account with a challenger bank are considerably more likely than the average consumer with a bank account to identify a range of factors as important when choosing a bank or building society, posing potential opportunities for challenger banks to engage prospective new customers via these means.

However, only a fifth of challenger bank customers consider the availability of local, staffed branches an important factor, compared to 27% of bank account users as a whole.

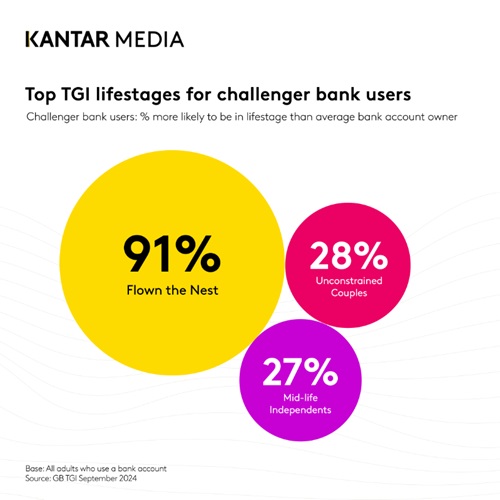

Challenger bank users are particularly likely to be at younger end of age spectrum

Challenger bank users are particularly likely compared to the average bank account user to be in the younger TGI lifestage groups, such as ‘Flown the Nest’ (aged 15-34, not married/living as a couple, do not live with relations) and ‘Nest Builders’ (aged 15-34, married/living as a couple, do not live with son/daughter).

However, they are also more likely to be in certain older lifestages, including ‘Unconstrained Couples’ (aged 35-54, married/living as a couple, do not live with son/daughter) and ‘Mid-life Independents’ (aged 35-54, not married/living as a couple, do not live with relations) – indicating that their profile may be evolving and becoming more mature.

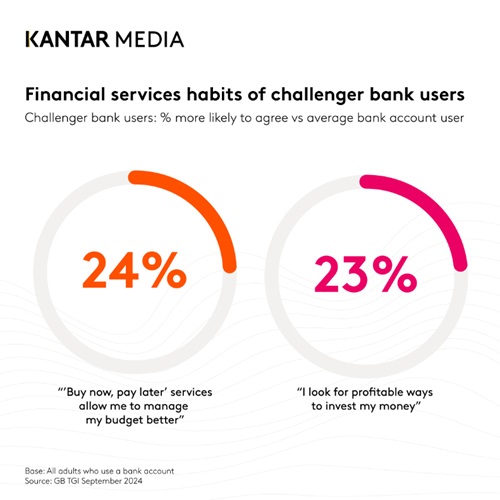

Challenger bank users more likely to engage with credit and investing

Challenger bank users are also 25% more likely to live in London than the average bank account holder. This is significant, as Londoners are particularly likely to demonstrate a range of financial habits compared to bank account holders in other areas of the country, including consulting a financial adviser, spending on credit cards and showing interest in responsible financial products that have a positive impact on society.

Indeed, this chimes with challenger bank users being much more likely than the average bank account holder to hold certain financial behaviours, especially willingness to use credit and a desire to engage with investing. Indeed, TGI reveals that users of challenger banks are 45% more likely to claim to have a loan than the average bank account owner.

When it comes to investments, they are more likely than other bank account holders to claim to hold unit trusts (24% more likely) and government stock (21% more likely). This willingness to embrace debt and investment opportunities creates opportunities for challenger brands to engage existing and potential customers with offers in these spaces.

Challenger bank users particularly likely to be in segment showing financial confidence

Using TGI’s new segmentation of British consumers by their financial behaviours and priorities, users of challenger banks are particularly likely to be found within the segment that displays a particular predilection towards being financially aware, confident and responsible. Such attributes can inform the kinds of messaging from banks that will resonate with these consumers.

The grouping in which challenger bank customers are particularly likely to sit contains consumers who are significantly more likely than the average adult to agree that financial security after retirement is one’s own responsibility, to feel that they are very good at managing money and to trust banks to look after their money.