As consumers dip into savings at record levels to see them through the cost-of-living crisis we explore consumers at both ends of the savings spectrum

The Bank of England recently revealed consumers are dipping into savings accounts at record levels as the cost of living puts household finances under continued strain.

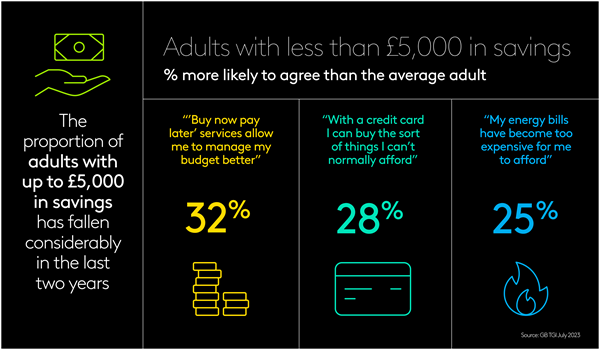

Indeed, latest GB TGI data shows that the evaporation of savings has been evolving in recent years. In 2019 the proportion of adults with up to £5,000 in savings stood at 35%. With the pandemic offering the chance for many to save money whilst under lockdown, by 2021 this figure had risen to 39%.

But as the cost-of-living crisis began to bite this fell sharply to 30% last year and 28% today. Meanwhile, a quarter of adults today claim they simply do not save at all.

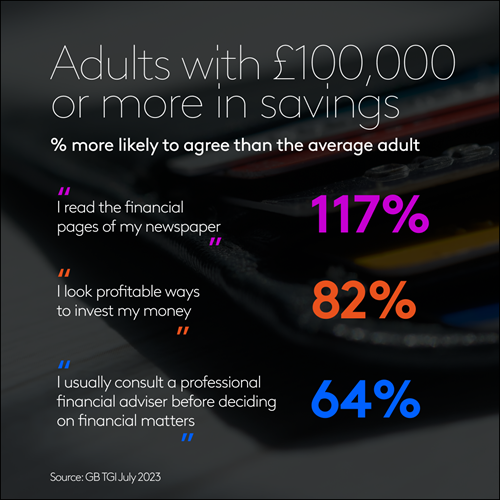

At the other end of the spectrum 9% of adults (4.9 million people) claim to have £100,000 or more in savings – a figure that has remained remarkably consistent even during the cost-of-living crisis.

Comparing the top differentiating attitudes of those at either end of the savings spectrum is very revealing in terms of their financial priorities. For those with under £5,000 in savings, ‘buy now pay later’ services, a reliance on credit cards to get by and struggles paying energy bills are all very apparent.

However, those with £100,000 or more saved are in a position to take a more structured approach to managing their finances, seek investment opportunities and enlist the help of experts to manage their money.

Those with less than £5,000 saved are particularly likely to be in the ‘Playschool Parents’ TGI lifestage group (39% more likely), with the cost of young children no doubt impacting their ability to save.

However, this group with relatively modest savings are also 35% more likely than the average adult to be ‘Mid-life Independents’ (aged 35-54, not married or living as a couple, do not live with relations). This might in part be explained by Mid-life Independents being over twice as likely as the average adult to be either divorced or separated, which can bring profound financial challenges.

Meanwhile, those who have £100,000 or more in savings are over two and a half times more likely than the average adult to be ‘Childfree Senior Couples’ (aged 55+, married/living as a couple and never had children). A lifetime of having the opportunity to build savings, a higher likelihood of having already paid off their mortgage and without young children to spend on puts this group in a much stronger position with regards how much money they can keep in the bank.

When it comes to media engagement, those with under £5,000 in savings are 23% more likely than the average adult to be heavy consumers of gaming.

At the other end of the scale, those with £100,000 or more saved are particularly likely to be heavy consumers of a range of media, most notably newspapers, magazines and addressed mail.