The cost-of-living crisis has prompted accelerated consumer engagement with money management apps as consumers look for ways to budget better

The impact of the cost of living crisis has acted as a prompt for some consumers to embrace money management apps, enabling them to consolidate their financial records in one place and analyse their spending to understand how they can budget better.

New monthly topic data on our July GB TGI survey reveals how adults today are engaging with this rapidly evolving market.

Indeed, the proportion of adults in Britain who claim to have an account with prominent money management experts Monzo, Starling, or Revolut, has accelerated recently. Prior to the cost of living crisis in 2020, 5% of adults claimed to have an account with one of these providers.

This crept up to 6% by 2022, but in the last year the figure has jumped to 9% of adults (4.6 million people), no doubt accelerated by consumers feeling they need to get more of a handle on where their money is going.

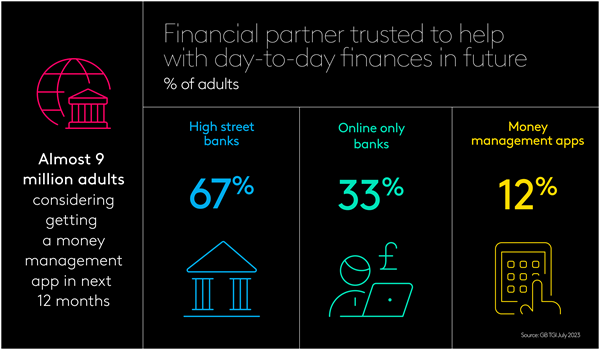

Further to this, 8.9 million consumers (17% of adults) say they are considering getting a money management app in the next 12 months, whilst 20% of consumers today (10.3 million people) say they find budgeting their finances easier using money management apps (e.g. Revolut, Moneybox) than using traditional banks – showing the huge scope for growth in this burgeoning market.

Whilst trust in high street banks continues to outstrip money management apps when it comes to which financial partners consumers would trust to help them with day-to-day finances in the future, a considerable minority of the adult population today nevertheless choose money management apps as the financial partner they trust.

Perhaps revealing current pressures on personal budgets and the desire to keep some funds in reserve to cover emergency costs, the most popular intention for use of money management apps in the next 12 months is to put money aside, which six in 10 of these app users intend to do.

This is followed in second place by budgeting day-to-day finances.

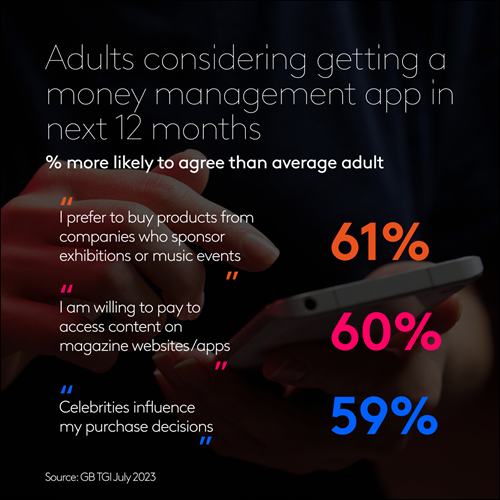

When it comes to targeting those considering getting a money management app in the next 12 months, TGI reveals that they are considerably more likely than the average adult to engage with a wide range of media, providing many opportunities to reach this audience efficiently.

These include engagement with event sponsorship, content on magazine sites/apps and celebrity endorsement.